Life insurance has many uses, including income replacement, business continuation, and estate preservation. Long-term care insurance provides financial

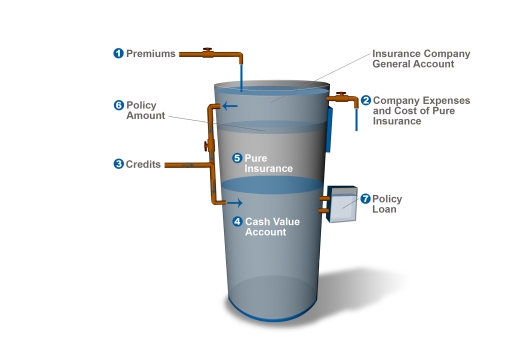

- The premium you "pour in" is fixed for the life of the policy. As you age, the cost of insuring your life increases. However, your premium stays the same

- The premium you "pour in" is fixed for the life of the policy. As you age, the cost of insuring your life increases. However, your premium stays the

The federal government insures certain pension benefits. Specifically, it insures defined benefit plans (but not other types of retirement plans) through the

Answer:

Vesting occurs when you acquire ownership. Does your employer offer a retirement savings plan such as a 401(k), traditional pension, or profit

If you're like most people, you bought life insurance to provide for your loved ones in the event of your death. But because you're self-employed, you may have

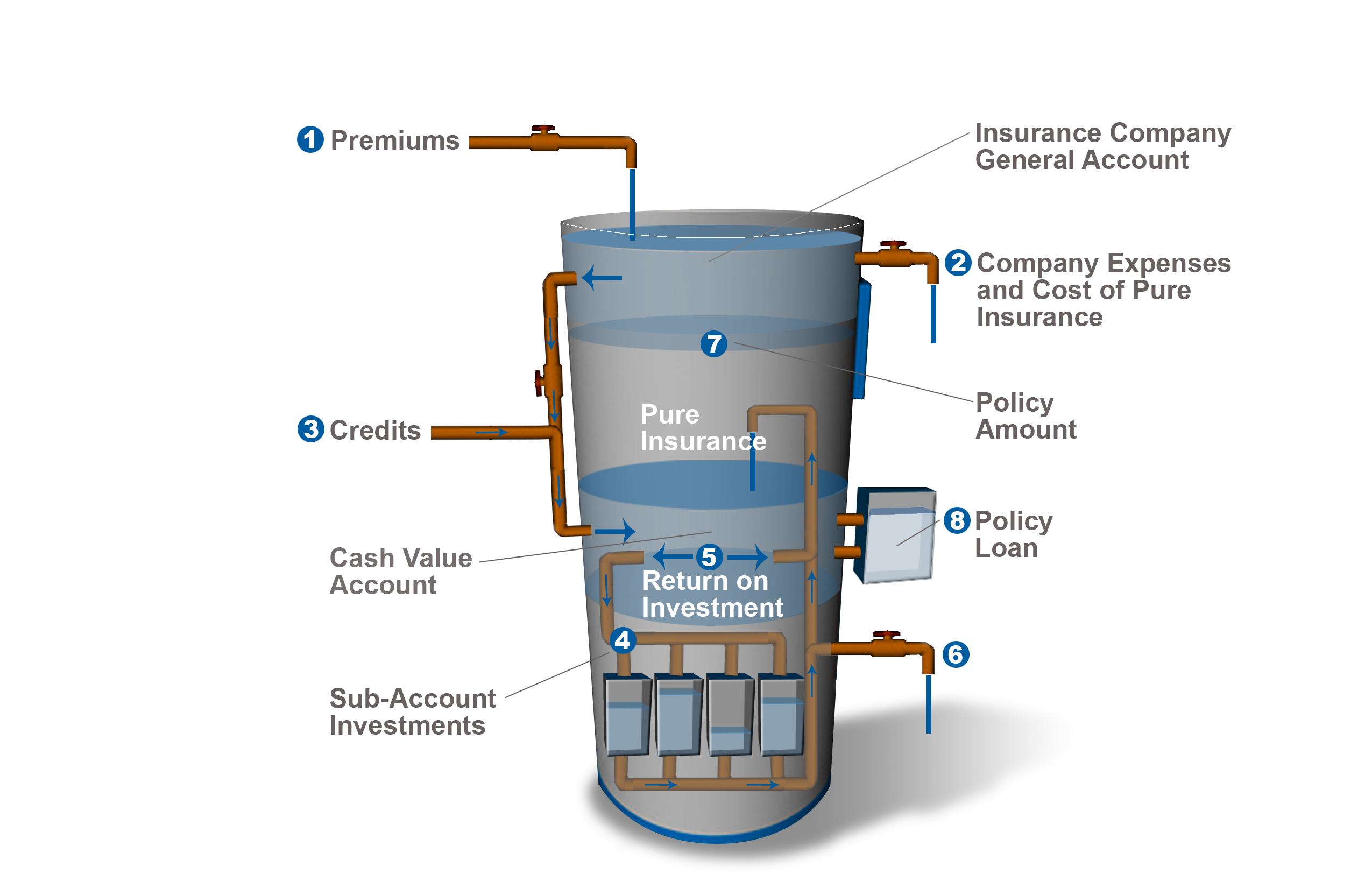

Indexed universal life insurance (IUL) is a type of permanent, cash value life insurance. Like universal life insurance (UL), IUL offers you the ability to

ISOs are a form of stock option that employers can grant to employees. A stock option is a right to buy a specified number of the company's shares at a

You want to retire comfortably when the time comes. You also want to help your child go to college. So how do you juggle the two? The truth is, saving for your

A portion of your benefits may be subject to income tax if your modified adjusted gross income (MAGI), plus one-half your Social Security benefits, exceeds

As you enter your 60s and 70s, health may become more of an issue than it once was, and your thoughts may turn to the future. Who will take care of you when you

When you determine how much income you'll need in retirement, you may base your projection on the type of lifestyle you plan to have and when you want to retire